Permian Resources Corporation (NYSE: PR) stands out as a prominent player in the oil and gas sector, particularly in the prolific Permian Basin. As energy markets evolve, Permian Resources has gained attention from investors seeking opportunities in domestic energy production. This article explores the company’s business model, financial performance, market position, and the potential benefits and risks of investing in its stock.

Overview of Permian Resources Corporation

Permian Resources Corporation is an independent oil and gas exploration and production company primarily focused on the Permian Basin. The Permian Basin, spanning West Texas and southeastern New Mexico, is one of the most productive oil and gas regions in the world. Permian Resources leverages advanced drilling techniques and operational efficiencies to maximize production and shareholder returns.

Founded on a strong commitment to innovation and sustainability, the company combines traditional energy production with forward-looking practices that consider environmental, social, and governance (ESG) factors. This dual focus ensures Permian Resources remains competitive and resilient amid shifting market dynamics.

The Significance of the Permian Basin

The Permian Basin is a cornerstone of the U.S. energy landscape, holding significant reserves of oil and natural gas. It is characterized by:

- Vast Resources: The basin has prolific hydrocarbon deposits, making it one of the largest oil-producing regions in the world.

- Technological Advancements: Horizontal drilling and hydraulic fracturing have unlocked reserves previously deemed uneconomical.

- Infrastructure: Well-established pipelines and export facilities support efficient transportation to domestic and international markets.

Permian Resources Corporation’s strategic positioning in this region provides a competitive advantage, enabling it to deliver consistent production growth and capitalize on high-margin opportunities.

Financial Performance and Growth Strategy

Permian Resources has demonstrated robust financial performance, with a strong balance sheet and disciplined capital allocation strategy. Key metrics to consider include:

Revenue Growth

The company’s revenues have benefited from higher production volumes and favorable commodity prices. By efficiently managing costs, Permian Resources has maintained solid profit margins, even during periods of market volatility.

Free Cash Flow (FCF)

Permian Resources prioritizes generating free cash flow to fund capital expenditures, reduce debt, and return value to shareholders through dividends and share buybacks. Its commitment to maintaining positive FCF highlights the company’s financial discipline.

Operational Efficiency

Through the implementation of cutting-edge technologies and a focus on operational efficiencies, Permian Resources has achieved competitive lifting costs and improved well productivity. This efficiency drives profitability and enhances shareholder value.

Market Position and Competitive Edge

Permian Resources competes with other independent and major oil and gas companies operating in the Permian Basin. Its competitive advantages include:

- Asset Quality: The company’s acreage is situated in prime locations with high resource density and low extraction costs.

- Technological Innovation: Permian Resources leverages data analytics and advanced drilling techniques to optimize well placement and maximize recovery rates.

- Scalable Operations: The company’s scalable operations enable it to quickly adjust to market conditions, ensuring resilience during price fluctuations.

- Commitment to ESG: With a focus on minimizing its environmental footprint, Permian Resources is well-positioned to meet growing investor demand for sustainable practices.

Benefits of Investing in Permian Resources Corporation

Investing in Permian Resources Corporation offers several potential benefits:

Exposure to Energy Markets

The oil and gas sector provides exposure to global energy markets. As demand for energy continues to grow, particularly in emerging economies, companies like Permian Resources stand to benefit.

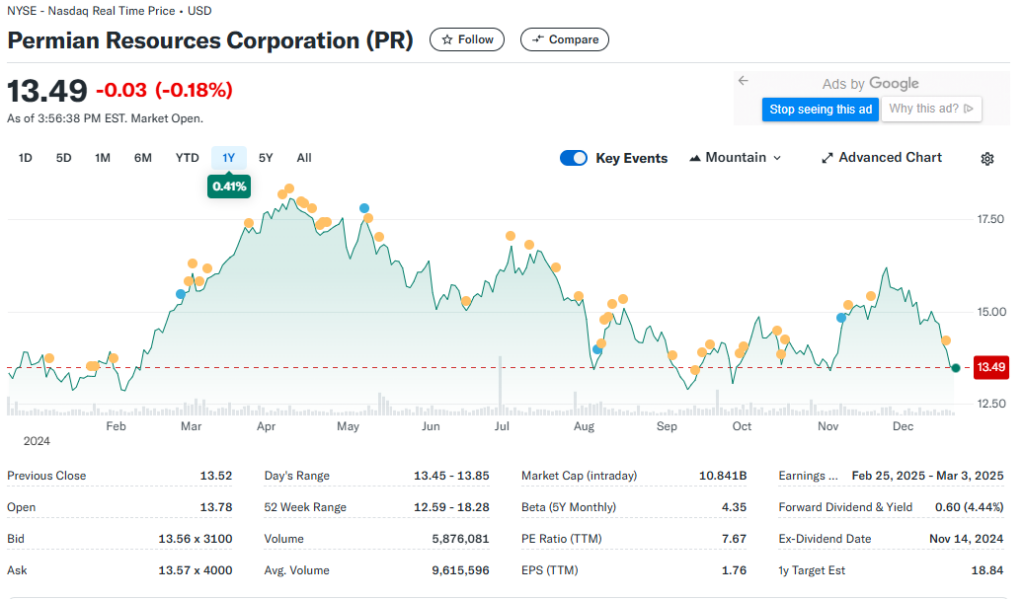

Dividend Yield

Permian Resources’ commitment to returning capital to shareholders makes it an attractive option for income-focused investors. The company’s dividends and share repurchase programs reflect its financial health and shareholder-friendly approach.

Growth Potential

The combination of high-quality assets, operational efficiency, and strategic investments positions Permian Resources for sustainable growth. As the company continues to develop its acreage and expand production, investors can expect long-term value creation.

Resilience in Market Downturns

Permian Resources’ focus on cost control and balance sheet strength ensures it can weather periods of low oil and gas prices. This resilience adds stability to its investment profile.

Risks and Challenges

While Permian Resources Corporation offers compelling investment opportunities, potential risks should be considered:

Commodity Price Volatility

Oil and gas prices are subject to significant fluctuations due to geopolitical tensions, supply-demand imbalances, and economic factors. These fluctuations can impact Permian Resources’ revenues and profitability.

Regulatory and Environmental Risks

The oil and gas industry faces increasing scrutiny from regulators and environmental groups. Stricter regulations or public opposition to fossil fuels could affect the company’s operations and growth prospects.

Operational Risks

Exploration and production activities involve technical challenges and risks, including equipment failures and geological uncertainties. These risks can lead to increased costs and production delays.

Competition

The Permian Basin is a highly competitive region, with numerous players vying for market share. Permian Resources must continue to innovate and maintain cost advantages to stay ahead of competitors.

ESG Initiatives and Sustainability

Permian Resources Corporation’s focus on ESG factors enhances its appeal to environmentally conscious investors. Key initiatives include:

- Emissions Reduction: The company employs technologies to minimize greenhouse gas emissions and flaring.

- Water Management: Innovative water recycling programs reduce the environmental impact of hydraulic fracturing.

- Community Engagement: Permian Resources invests in local communities, creating jobs and supporting economic development.

By integrating ESG principles into its operations, Permian Resources aligns with global sustainability trends and positions itself for long-term success.

How to Invest in Permian Resources Corporation

Investors can gain exposure to Permian Resources Corporation through several methods:

Direct Stock Purchase

Purchasing shares of Permian Resources on the New York Stock Exchange (NYSE: PR) allows investors to participate directly in the company’s performance.

Exchange-Traded Funds (ETFs)

ETFs focused on the energy sector or domestic oil and gas producers often include Permian Resources in their portfolios, offering diversified exposure.

Dividend Reinvestment Plans (DRIPs)

Investors seeking to maximize returns may consider DRIPs, which reinvest dividends into additional shares of the company.

Long-Term Investment Strategies

Given the cyclical nature of the oil and gas industry, a long-term investment approach can help investors ride out market volatility and benefit from Permian Resources’ growth potential.

Conclusion

Permian Resources Corporation is a compelling investment opportunity for those looking to capitalize on the energy sector’s growth and the robust production potential of the Permian Basin. With its strong financial performance, commitment to sustainability, and strategic positioning, the company is well-equipped to navigate industry challenges and deliver shareholder value.

As with any investment, potential risks should be carefully considered. Investors are encouraged to conduct thorough due diligence and consult with financial advisors to determine if Permian Resources aligns with their investment objectives. By balancing opportunities and risks, Permian Resources Corporation offers a promising avenue for growth in the dynamic energy sector.