When evaluating investment opportunities, particularly in the biopharmaceutical sector, Insmed Incorporated (NASDAQ: INSM) emerges as a compelling player worth consideration. As a company focused on addressing rare diseases and unmet medical needs, Insmed offers a distinctive value proposition. This article delves into the company’s background, recent developments, financial performance, market potential, and key risks to provide a 360-degree view of investing in Insmed.

Company Overview

Insmed is a global biopharmaceutical company dedicated to developing and commercializing therapies for patients with serious and rare diseases. Headquartered in Bridgewater, New Jersey, the company’s flagship product, Arikayce, targets Mycobacterium avium complex (MAC) lung disease, a chronic and often debilitating condition. Approved by the U.S. Food and Drug Administration (FDA) under an accelerated approval pathway, Arikayce has been a significant contributor to Insmed’s growth.

Beyond Arikayce, Insmed’s robust pipeline includes therapies targeting other rare conditions, including its brensocatib program for bronchiectasis and treprostinil palmitil inhalation powder (TPIP) for pulmonary arterial hypertension. The company’s commitment to innovation and addressing underserved patient populations underpins its potential for sustained growth.

Industry Landscape

The rare disease and orphan drug markets are among the fastest-growing segments in the pharmaceutical industry. According to market research, the global orphan drug market is projected to exceed $350 billion by 2030, growing at a compound annual growth rate (CAGR) of over 10%. Drivers of this growth include advancements in genomics, favorable regulatory incentives, and increased awareness of rare diseases.

Insmed’s focus on rare diseases places it squarely in this high-growth sector. Regulatory agencies such as the FDA and European Medicines Agency (EMA) often provide benefits like market exclusivity, tax credits, and priority reviews for orphan drug developers. These incentives reduce financial barriers and enhance the commercial viability of novel therapies.

Recent Developments

- Pipeline Progress: Insmed has made significant strides in advancing its pipeline:

- Brensocatib: Currently in Phase 3 trials, brensocatib is being evaluated for non-cystic fibrosis bronchiectasis, a condition lacking effective treatments. Positive interim data has bolstered investor confidence.

- TPIP: This novel inhaled formulation of treprostinil is under investigation for pulmonary hypertension. Preclinical and early-phase clinical data suggest strong therapeutic potential.

- Geographic Expansion: The company has been expanding its geographic footprint. Arikayce’s approval in Japan and Europe underscores Insmed’s global aspirations and adds diversified revenue streams.

- Strategic Collaborations: Insmed continues to explore partnerships to accelerate research and development. Collaborations with academic institutions and other biopharma companies enhance the company’s innovative capabilities.

Financial Performance

As of the latest financial reports, Insmed’s revenues are primarily driven by Arikayce sales. The company reported $276.8 million in revenue for the first three quarters of 2023, reflecting steady growth. While the company remains in a net loss position, as is common for biopharmaceutical firms in the growth phase, it boasts a strong cash position of approximately $1 billion. This liquidity provides a buffer for ongoing R&D activities and commercial expansion.

Investment Thesis

1. Strong Product Portfolio

Arikayce’s commercial success lays a solid foundation for Insmed. The drug’s unique formulation—delivered via a specialized nebulizer—enables it to penetrate lung tissues effectively, setting it apart from conventional therapies. The potential expansion of Arikayce’s indications further enhances its revenue prospects.

2. Robust Pipeline

Insmed’s pipeline is a key driver of its long-term value. Brensocatib’s potential approval could address a multibillion-dollar market, while TPIP adds diversity to the portfolio. These programs exemplify the company’s strategy of targeting high unmet medical needs.

3. Favorable Regulatory Environment

Orphan drug designations and regulatory support provide Insmed with significant competitive advantages. Accelerated approval pathways and market exclusivity periods allow the company to bring therapies to market efficiently.

4. Growth Potential in Global Markets

Expanding into Japan and Europe diversifies Insmed’s revenue base and reduces reliance on the U.S. market. This international strategy aligns with the global prevalence of targeted diseases, increasing the addressable market.

Risks and Challenges

1. Clinical Trial Outcomes

The success of Insmed’s pipeline hinges on clinical trial results. Any setbacks—such as unfavorable data for brensocatib or TPIP—could impact the company’s valuation significantly.

2. Regulatory Hurdles

While orphan drug designations offer advantages, regulatory agencies maintain stringent standards. Delays or rejections could disrupt Insmed’s timelines and financial performance.

3. Competitive Landscape

The rare disease market is increasingly competitive. Established players and emerging biotechs are developing innovative therapies, intensifying the battle for market share.

4. Financial Sustainability

Although Insmed has a strong cash position, it remains unprofitable. The company’s ability to sustain operations and invest in R&D relies on prudent financial management and potential future capital raises.

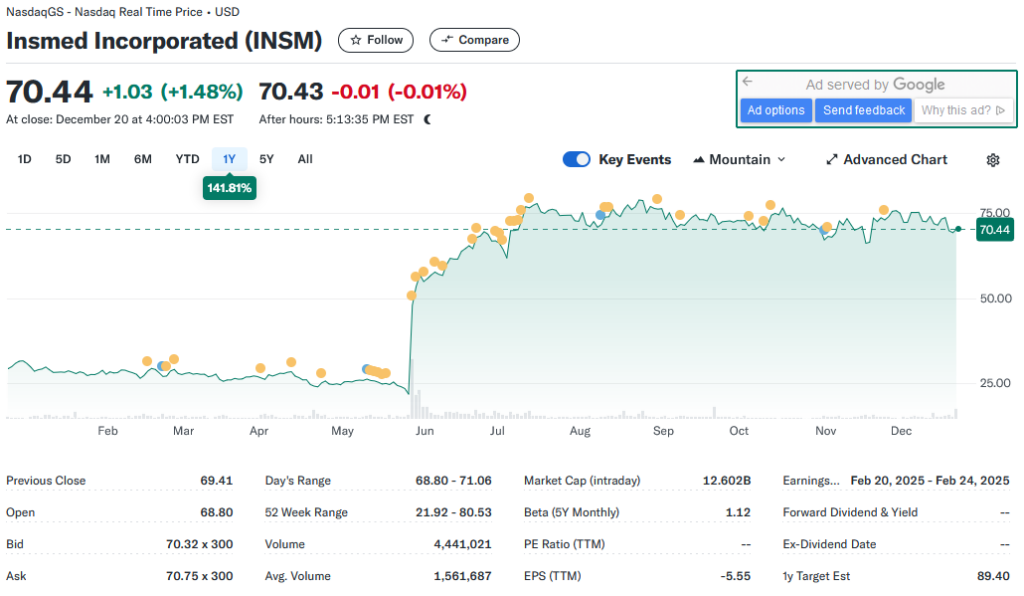

Valuation Metrics

Insmed’s valuation reflects its growth potential and inherent risks. The company trades at a price-to-sales (P/S) ratio of approximately 12, higher than the biotech industry average. This premium valuation underscores investor optimism but also amplifies the impact of any negative developments.

Conclusion

Insmed Incorporated presents an intriguing investment opportunity for those with an appetite for the risks and rewards associated with biopharmaceutical stocks. The company’s focus on rare diseases, strong product portfolio, and promising pipeline provide a solid foundation for future growth. Additionally, its strategic geographic expansion and regulatory incentives enhance its long-term prospects.

However, potential investors should remain cognizant of the risks, including clinical trial uncertainties, regulatory hurdles, and the company’s unprofitable status. For risk-tolerant investors, Insmed could serve as a high-growth addition to a diversified portfolio. As with any investment, thorough due diligence and an understanding of the broader market context are essential when considering a position in Insmed Incorporated.