Chord Energy Corporation (NASDAQ: CHRD) has emerged as a significant player in the oil and gas exploration and production (E&P) sector. As the global energy landscape undergoes rapid changes due to shifting demand, technological innovation, and the transition toward cleaner energy sources, companies like Chord Energy must navigate a complex environment while striving for profitability and growth. For investors, understanding the nuances of Chord Energy’s operations, financial health, and strategic direction is essential for making informed investment decisions.

Overview of Chord Energy Corporation

Chord Energy Corporation, formed through the merger of Oasis Petroleum Inc. and Whiting Petroleum Corporation, operates primarily in the Williston Basin, which includes key areas such as North Dakota and Montana. The company focuses on shale oil and natural gas production, leveraging advanced technologies to maximize resource recovery and efficiency.

Chord Energy’s strategic location in the prolific Bakken and Three Forks formations provides a solid foundation for its operations. These formations are among the most productive shale plays in North America, offering substantial reserves and low breakeven costs. By consolidating assets and expertise, Chord Energy aims to enhance operational efficiency and deliver sustainable returns to shareholders.

Market Position and Competitive Landscape

In the highly competitive E&P sector, Chord Energy differentiates itself through a combination of operational excellence, strong financial discipline, and a commitment to shareholder value. The company’s strategy revolves around disciplined capital allocation, focusing on high-return projects while maintaining a robust balance sheet.

Compared to larger peers such as ExxonMobil and Chevron, Chord Energy is a mid-cap company with more focused operations. This allows the company to respond more nimbly to market conditions and capitalize on regional opportunities. However, it also exposes Chord Energy to higher volatility, given its dependence on specific assets and market dynamics.

Financial Performance

A key factor for investors evaluating Chord Energy is its financial performance. Over the past several quarters, the company has demonstrated strong cash flow generation and a commitment to returning capital to shareholders through dividends and share repurchases.

Revenue and Profitability: Chord Energy has benefited from favorable commodity prices and operational efficiencies, translating into robust revenue growth. The company’s cost-control measures have further bolstered profitability, enabling it to achieve industry-leading margins.

Balance Sheet Strength: A healthy balance sheet is critical in the cyclical oil and gas industry. Chord Energy has prioritized debt reduction and liquidity, positioning itself to weather downturns and capitalize on growth opportunities. With a low debt-to-equity ratio and significant cash reserves, the company is well-prepared for market uncertainties.

Shareholder Returns: Chord Energy’s commitment to shareholder value is evident in its dividend policy and share repurchase program. The company’s dividend yield compares favorably to industry peers, and its buybacks underscore management’s confidence in the company’s long-term prospects.

Operational Efficiency

Chord Energy has consistently demonstrated operational efficiency, which is vital in the cost-intensive E&P sector. The company employs advanced drilling and completion techniques, including horizontal drilling and multi-stage hydraulic fracturing, to maximize resource recovery. Additionally, its focus on optimizing production and reducing operating costs has contributed to strong financial performance.

The company’s operations in the Williston Basin benefit from economies of scale and proximity to established infrastructure. This allows Chord Energy to achieve lower transportation costs and higher netbacks compared to operators in less developed regions. Furthermore, the company’s emphasis on environmental stewardship and community engagement supports its social license to operate, a critical factor in today’s ESG-focused investment environment.

ESG Considerations

Environmental, Social, and Governance (ESG) factors play an increasingly important role in investment decisions, particularly in the energy sector. Chord Energy has taken steps to address ESG concerns, recognizing that sustainable practices are essential for long-term success.

Environmental Stewardship: The company is committed to reducing greenhouse gas (GHG) emissions and minimizing its environmental footprint. Initiatives such as flaring reduction, water recycling, and investments in cleaner technologies underscore Chord Energy’s dedication to environmental responsibility.

Social Responsibility: Chord Energy engages with local communities and stakeholders to foster positive relationships and support regional development. The company’s safety programs and employee training initiatives further demonstrate its commitment to social responsibility.

Governance Practices: Strong corporate governance is a hallmark of Chord Energy’s management approach. The company maintains transparency and accountability through robust disclosure practices and adherence to ethical business standards.

Industry Trends and Outlook

The oil and gas industry is influenced by a multitude of factors, including global economic conditions, geopolitical events, and technological advancements. For Chord Energy, several key trends are likely to shape its trajectory:

1. Commodity Price Volatility: Oil and gas prices remain subject to significant fluctuations due to supply-demand imbalances and external shocks. Chord Energy’s hedging strategies and cost discipline help mitigate exposure to price volatility.

2. Energy Transition: The global shift toward cleaner energy sources presents both challenges and opportunities for E&P companies. While oil and gas will remain vital components of the energy mix for decades, Chord Energy’s focus on operational efficiency and ESG initiatives positions it to adapt to changing market dynamics.

3. Technological Innovation: Advances in drilling and production technologies continue to drive efficiency gains across the industry. Chord Energy’s commitment to innovation ensures it remains competitive in an evolving landscape.

4. Regulatory Environment: The oil and gas sector faces increasing scrutiny from regulators and policymakers. Chord Energy’s proactive approach to compliance and sustainability mitigates regulatory risks and enhances its reputation.

Investment Risks

As with any investment, there are inherent risks associated with Chord Energy. Potential investors should consider the following:

Commodity Price Risk: Chord Energy’s revenue and profitability are highly sensitive to oil and gas prices. A prolonged downturn in commodity prices could impact its financial performance.

Operational Risks: Exploration and production activities involve technical and operational challenges, including equipment failures, cost overruns, and production disruptions.

Regulatory and ESG Risks: Changes in regulations or increased scrutiny of ESG practices could pose challenges for the company.

Market and Competitive Risks: The E&P sector is highly competitive, with numerous players vying for market share. Chord Energy’s ability to maintain its competitive edge is crucial for long-term success.

Valuation and Investment Considerations

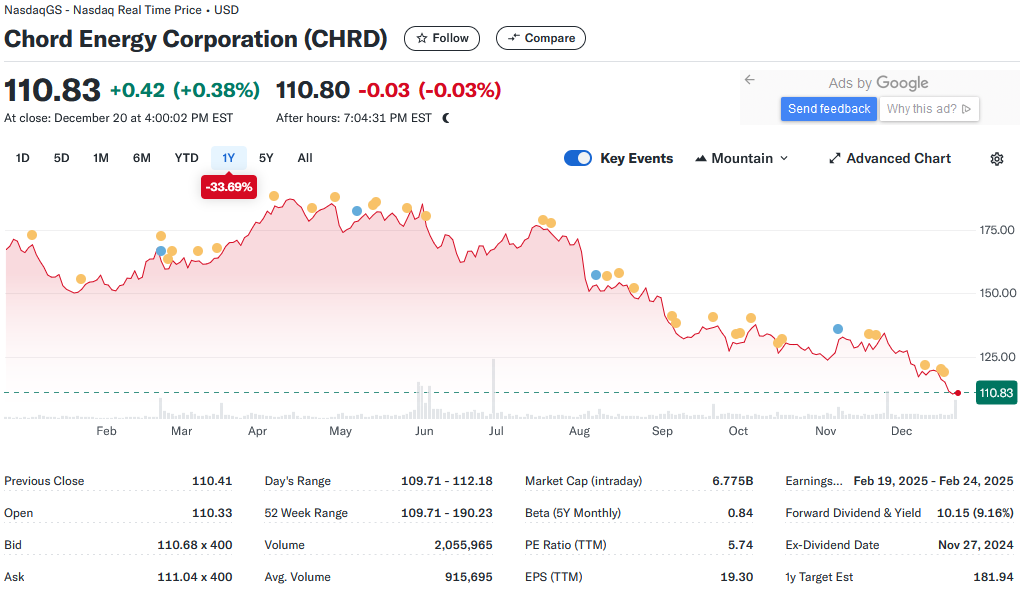

Chord Energy’s valuation metrics, such as price-to-earnings (P/E) ratio, enterprise value-to-EBITDA, and free cash flow yield, provide insights into its investment appeal. The company’s relatively low valuation compared to peers may present an attractive opportunity for value-oriented investors, particularly given its strong financial position and growth potential.

Moreover, Chord Energy’s focus on returning capital to shareholders enhances its appeal to income-focused investors. Its combination of dividend income and potential capital appreciation makes it a compelling option in the energy sector.

Conclusion

Chord Energy Corporation represents a dynamic investment opportunity in the oil and gas sector. The company’s strong financial performance, operational efficiency, and commitment to ESG principles provide a solid foundation for long-term growth. While risks such as commodity price volatility and regulatory challenges remain, Chord Energy’s strategic approach and focus on shareholder value position it well to navigate these uncertainties.

For investors seeking exposure to the energy sector, Chord Energy offers a balanced mix of growth potential and income generation. As the company continues to execute its strategy and adapt to an evolving industry landscape, it remains a noteworthy contender in the E&P space. Conducting thorough due diligence and staying informed about market developments will be crucial for investors considering Chord Energy as part of their portfolio.