Investing in the stock market offers a plethora of opportunities, and one of the companies garnering attention in recent years is API Group Corporation (NYSE: APG). A leader in providing safety, specialty, and industrial services, API Group has carved out a unique position in a niche market. This article explores the company’s business model, financial health, market prospects, and why it might be a compelling addition to your investment portfolio.

Understanding API Group Corporation

Founded in 1926 and headquartered in New Brighton, Minnesota, API Group is a diversified business services provider operating in over 20 countries. The company primarily focuses on safety solutions, such as fire protection, security systems, and industrial services that cater to various industries, including commercial, industrial, and residential sectors.

API Group’s operations are structured around three main segments:

- Safety Services

This division focuses on fire protection and life safety systems, including installation, inspection, and maintenance. As regulations around fire safety continue to evolve globally, this segment represents a growing and stable revenue stream. - Specialty Services

Specialty services include energy solutions and infrastructure services. API Group is involved in projects such as pipeline integrity and maintenance, ensuring compliance with environmental and safety standards. - Industrial Services

This segment provides maintenance and repair services for industrial facilities, ensuring minimal downtime and optimal productivity for its clients.

API Group’s diverse offerings have enabled it to build long-term relationships with clients in critical industries such as healthcare, data centers, and utilities.

Market Potential

1. Growing Demand for Safety Solutions

The increasing emphasis on safety regulations and compliance is driving demand for API Group’s services. With the rise in urbanization and infrastructure development, governments and businesses worldwide are prioritizing safety. This trend creates a favorable environment for companies like API Group, which specialize in fire safety and security solutions.

2. Resilience During Economic Downturns

One of API Group’s competitive advantages is its focus on essential services. Safety and maintenance are critical, irrespective of economic cycles. This resilience was evident during the COVID-19 pandemic when the company maintained stable revenue streams despite challenging market conditions.

3. Infrastructure Investment Boom

As governments globally allocate trillions of dollars toward infrastructure development and modernization, API Group is well-positioned to benefit. The company’s expertise in specialty services and industrial maintenance makes it a preferred partner for large-scale infrastructure projects.

Financial Performance

API Group has demonstrated consistent financial performance over the years. Let’s delve into some key metrics that highlight its stability and growth potential:

Revenue Growth

API Group’s revenues have shown a steady upward trajectory, driven by organic growth and strategic acquisitions. For the fiscal year 2023, the company reported revenues of approximately $6 billion, reflecting its ability to secure new contracts and retain existing clients.

Profit Margins

The company’s focus on high-margin services, particularly in its safety and specialty segments, has translated into healthy operating margins. Additionally, API Group’s ability to optimize its cost structure has improved net profitability.

Strong Balance Sheet

With a prudent approach to debt management, API Group boasts a solid balance sheet. Its debt-to-equity ratio is manageable, and the company’s strong cash flow generation provides flexibility for future investments and acquisitions.

Earnings Growth

API Group’s earnings per share (EPS) have seen consistent growth over the past few years. This trend reflects the company’s operational efficiency and ability to capitalize on market opportunities.

Competitive Advantages

1. Diversified Revenue Streams

API Group’s diversified portfolio across safety, specialty, and industrial services mitigates risk. Even if one segment faces a slowdown, the other divisions provide stability, ensuring consistent revenue growth.

2. Strategic Acquisitions

The company has a history of making strategic acquisitions to enhance its capabilities and market reach. For instance, the acquisition of Chubb Fire & Security from Carrier Global Corporation significantly bolstered API Group’s presence in the fire protection market.

3. Strong Customer Relationships

API Group has built long-term relationships with a diverse client base, including Fortune 500 companies. These relationships not only provide recurring revenue but also create opportunities for cross-selling its services.

4. Skilled Workforce

The company’s workforce comprises highly skilled professionals with expertise in various domains. This capability enables API Group to deliver complex projects with precision, reinforcing its reputation for reliability.

Growth Strategies

1. Expanding Global Footprint

While API Group has a strong presence in North America and Europe, the company is actively exploring opportunities in emerging markets. These regions offer significant growth potential due to increasing urbanization and infrastructure spending.

2. Emphasis on Digital Transformation

API Group is investing in technology to enhance its service offerings. From leveraging data analytics to improve predictive maintenance to integrating IoT-enabled solutions in safety systems, the company is positioning itself as a tech-forward player in its industry.

3. Focus on ESG Initiatives

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important for investors. API Group’s commitment to sustainability and safety aligns with these trends, making it an attractive choice for ESG-focused portfolios.

4. Leveraging Cross-Selling Opportunities

With a comprehensive range of services, API Group is well-equipped to cross-sell its offerings to existing clients. This strategy not only deepens client relationships but also drives incremental revenue growth.

Risks to Consider

Like any investment, API Group comes with its share of risks. Investors should be mindful of the following:

- Economic Sensitivity: While API Group’s services are essential, certain segments, such as specialty services, may be affected by economic downturns.

- Competition: The company operates in a competitive landscape, facing challenges from both established players and smaller, niche firms.

- Integration Challenges: While acquisitions are a key growth driver, integrating new businesses can pose operational and cultural challenges.

- Regulatory Risks: Changes in safety regulations or environmental policies could impact API Group’s operations and cost structure.

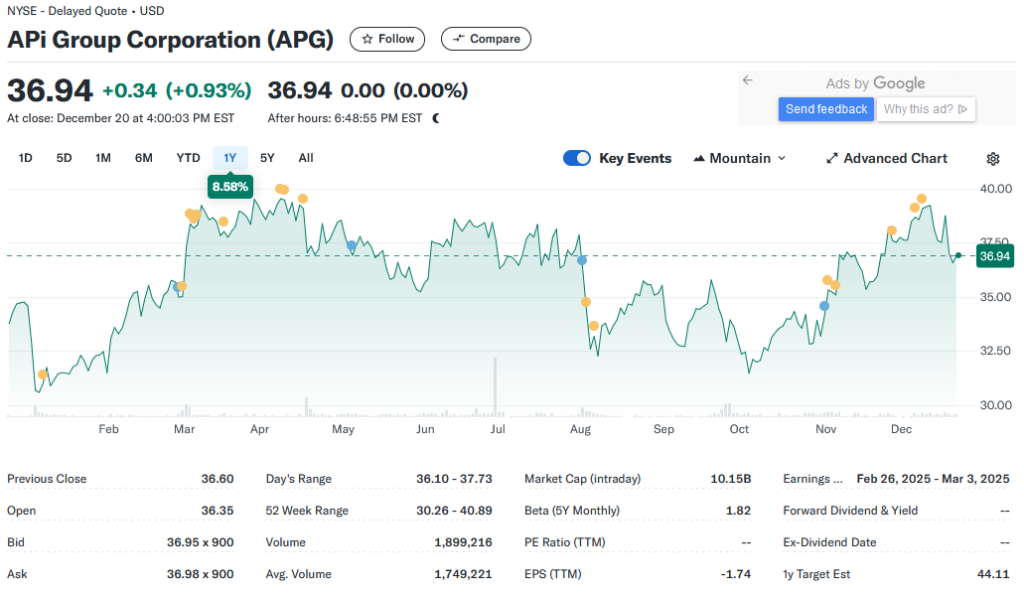

Valuation and Investment Outlook

API Group’s current valuation reflects its growth potential and resilience. The stock trades at a reasonable price-to-earnings (P/E) ratio compared to its industry peers. Additionally, the company’s focus on cash flow generation and shareholder returns makes it an appealing investment.

Dividend Policy

While API Group currently reinvests most of its earnings into growth initiatives, the potential for future dividend payouts adds to its attractiveness for long-term investors.

Growth Potential

Analysts project strong earnings growth for API Group in the coming years, driven by robust demand for its services and strategic initiatives.

Conclusion

API Group Corporation is a compelling investment opportunity for those seeking exposure to a resilient and growing industry. With its diversified service offerings, strong financial performance, and focus on innovation, the company is well-positioned to deliver long-term value.

Investors should, however, conduct their due diligence and consider their risk tolerance before making any investment decisions. API Group’s strong fundamentals, coupled with favorable market trends, make it a stock worth keeping on your radar.

By incorporating API Group into a diversified portfolio, investors can capitalize on the company’s growth trajectory while benefiting from its stability in an ever-changing market environment.