Applied Industrial Technologies, Inc. (NYSE: AIT) stands out as a pivotal player in the industrial distribution sector. With a rich history dating back to 1923, the company has grown into a leader in providing motion and control technologies. This article delves into the various facets of Applied Industrial Technologies (AIT) as an investment opportunity, exploring its business model, financial performance, competitive positioning, and growth potential.

Business Overview

AIT operates as a distributor of industrial products, specializing in bearings, power transmission products, fluid power components, and other critical industrial supplies. The company serves a broad array of industries, including manufacturing, energy, agriculture, and construction. With a robust distribution network of over 560 facilities across North America and international operations, AIT is well-positioned to meet the needs of its diverse customer base.

The company’s value proposition lies in its ability to combine an extensive product portfolio with specialized technical expertise. This dual focus enables AIT to differentiate itself in a competitive market, offering tailored solutions that drive operational efficiency for its customers.

Financial Performance

AIT’s financial health is a critical factor for investors. Over the past decade, the company has demonstrated consistent revenue growth, underpinned by organic expansion and strategic acquisitions. For fiscal 2023, AIT reported record revenues of $4.5 billion, reflecting a 10% year-over-year increase. This growth was fueled by strong demand across key end markets and effective pricing strategies.

The company’s profitability metrics also underscore its operational efficiency. AIT’s gross margin has remained steady at approximately 30%, while its operating margin has shown incremental improvement, reaching 10% in recent years. These figures reflect effective cost management and the scalability of its business model.

AIT’s balance sheet is another highlight. The company maintains a prudent capital structure, with a debt-to-equity ratio of 0.6 and ample liquidity. This financial stability provides flexibility for further investments in growth initiatives and shareholder returns.

Dividend and Shareholder Returns

For income-oriented investors, AIT’s dividend policy is an attractive feature. The company has a long history of dividend payments, having raised its dividend for over 12 consecutive years. In fiscal 2023, AIT declared an annual dividend of $1.60 per share, representing a yield of approximately 1.5% at current share prices.

In addition to dividends, AIT has pursued share repurchases to enhance shareholder value. Over the past five years, the company has repurchased approximately 5% of its outstanding shares, reflecting management’s confidence in the business.

Growth Drivers

AIT’s growth strategy is centered on several key initiatives:

- Expansion of Product Offerings: The company continuously broadens its product portfolio to meet evolving customer needs. Recent additions include advanced automation and robotics solutions, reflecting the growing importance of Industry 4.0 technologies.

- Strategic Acquisitions: Mergers and acquisitions (M&A) have been a cornerstone of AIT’s growth. Notable acquisitions include companies specializing in fluid power and industrial automation, which have enhanced AIT’s technical capabilities and geographic reach.

- Digital Transformation: AIT has invested heavily in digital tools and e-commerce platforms to improve customer engagement and streamline operations. These investments are expected to drive incremental revenue growth and margin expansion.

- Geographic Expansion: While North America remains AIT’s primary market, the company has identified international markets as a significant growth opportunity. Target regions include Latin America, Europe, and Asia-Pacific, where industrial activity is on the rise.

Competitive Landscape

AIT operates in a highly fragmented market, competing with both large players and smaller regional distributors. Key competitors include Motion Industries, Grainger, and Fastenal. Despite the intense competition, AIT’s scale, technical expertise, and strong customer relationships provide a competitive edge.

One of AIT’s differentiators is its focus on high-value technical services. Unlike many competitors that primarily act as product resellers, AIT offers comprehensive solutions, including system design, installation, and maintenance support. This approach not only enhances customer loyalty but also drives higher margins.

Risks and Challenges

While AIT presents a compelling investment case, it is not without risks. Key challenges include:

- Economic Cyclicality: AIT’s performance is closely tied to industrial activity, which can be cyclical. Economic downturns may lead to reduced demand for its products and services.

- Supply Chain Disruptions: Like many industrial companies, AIT is vulnerable to supply chain disruptions, which can impact product availability and pricing.

- Competition: The fragmented nature of the market means that AIT must continuously innovate and invest to maintain its competitive position.

- Technological Advancements: Rapid technological changes may require ongoing investments in R&D and employee training, potentially impacting margins.

Valuation

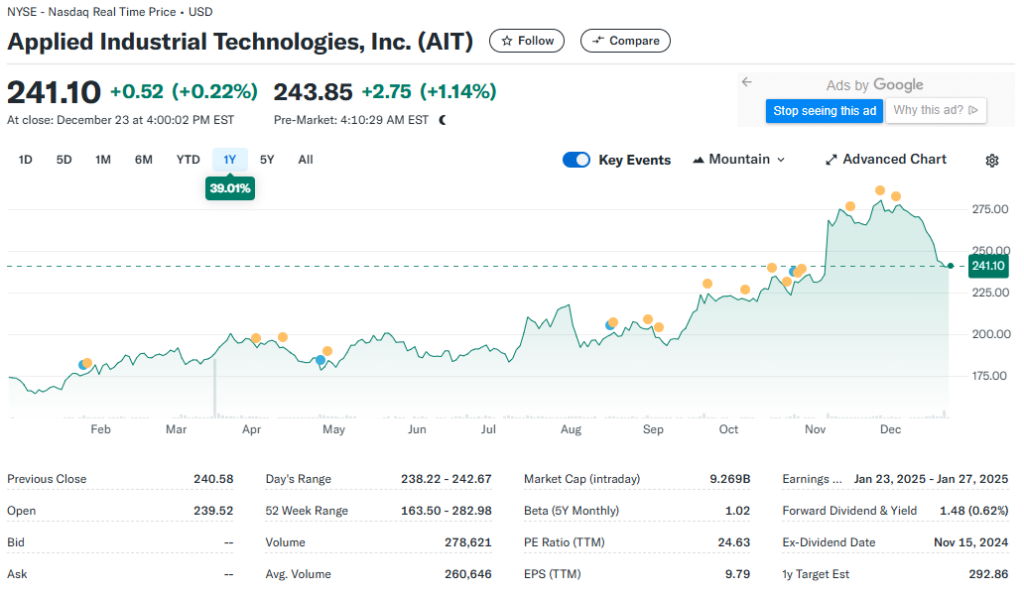

From a valuation perspective, AIT’s stock trades at a price-to-earnings (P/E) ratio of 18x, slightly below the industry average of 20x. This discount may reflect investor concerns about economic cyclicality but also presents a potential opportunity for value-oriented investors.

AIT’s forward P/E ratio, based on expected earnings growth, stands at 16x, indicating that the market anticipates continued profitability improvement. Additionally, the company’s enterprise value-to-EBITDA (EV/EBITDA) ratio of 10x suggests reasonable valuation relative to peers.

ESG Considerations

Environmental, Social, and Governance (ESG) factors are increasingly important for investors. AIT has taken steps to enhance its ESG profile, including:

- Sustainability Initiatives: The company offers energy-efficient products and solutions that help customers reduce their environmental footprint.

- Workforce Development: AIT invests in employee training and development, fostering a skilled and diverse workforce.

- Governance Practices: The company adheres to strong governance standards, with an independent board and transparent reporting practices.

While AIT has made progress, there is room for further improvement, particularly in setting specific sustainability targets and enhancing diversity metrics.

Analyst Ratings and Market Sentiment

Wall Street analysts generally have a positive outlook on AIT. The stock is rated as a “Buy” by most analysts, with an average price target of $170, implying upside potential of 15% from current levels. Analysts cite the company’s strong execution, growth initiatives, and resilient end markets as key drivers of this optimism.

Market sentiment is also favorable, with institutional investors, including mutual funds and pension funds, maintaining significant positions in AIT. Insider ownership, while modest, aligns management’s interests with those of shareholders.

Conclusion

Applied Industrial Technologies, Inc. offers a compelling investment opportunity for both growth and income-oriented investors. The company’s strong market position, consistent financial performance, and strategic growth initiatives provide a solid foundation for long-term value creation.

However, prospective investors should carefully consider the risks, particularly the potential impact of economic cyclicality and competitive pressures. Diversification and a long-term investment horizon are prudent approaches when investing in AIT or similar industrial companies.

In summary, AIT’s combination of steady dividend growth, reasonable valuation, and robust growth prospects makes it an attractive choice for investors seeking exposure to the industrial sector. As the company continues to execute its strategic initiatives, it is well-positioned to deliver sustainable returns in the years ahead.