ATI Inc. (Allegheny Technologies Incorporated) stands out as a key player in the specialty materials and components industry. With its innovative solutions and strong market presence, ATI has positioned itself as a formidable company in advanced materials, especially for industries like aerospace, defense, and energy. This article will explore why ATI Inc. is a solid investment opportunity, its growth drivers, market position, and financial health. Whether you’re a seasoned investor or a beginner, understanding ATI’s potential can help you make an informed decision.

Understanding ATI Inc.

Founded in 1996, ATI Inc. specializes in the development and production of high-performance materials and components. The company’s core products include titanium and nickel-based alloys, stainless steel, and other advanced materials used in critical applications. ATI’s focus on innovation and quality has allowed it to cater to demanding industries such as aerospace, medical, and energy, which require materials that can withstand extreme conditions.

ATI operates through two primary business segments:

- High-Performance Materials & Components (HPMC): This segment focuses on advanced alloy development, providing materials for jet engines, medical implants, and more.

- Advanced Alloys & Solutions (AA&S): Specializes in stainless steel and nickel-based alloys for industrial applications like chemical processing and automotive manufacturing.

Why Invest in ATI Inc.?

1. Robust Market Position

ATI has established itself as a leader in the specialty materials sector. Its products are indispensable to several industries, making it less susceptible to market fluctuations compared to other commodity-driven businesses. With a global presence, ATI benefits from diversified revenue streams, reducing risks associated with economic downturns in specific regions.

2. Strong Aerospace and Defense Ties

Aerospace and defense remain critical growth drivers for ATI. The company’s high-performance materials are essential for jet engines and defense applications. As global air travel continues to recover post-pandemic, the demand for advanced aerospace materials is surging. Additionally, governments worldwide are increasing defense spending, further boosting ATI’s prospects.

3. Focus on Sustainability

ATI is committed to sustainability, focusing on reducing its environmental footprint and promoting recyclable materials. This aligns with growing investor preferences for environmentally conscious companies. ATI’s investments in green energy applications and sustainable manufacturing processes position it as a future-ready enterprise.

4. Financial Resilience

ATI’s financial performance reflects its operational efficiency and market strength. With a consistent track record of revenue growth and profitability, the company has demonstrated resilience even during challenging economic periods. In 2023, ATI reported strong earnings growth, driven by robust demand and effective cost management.

5. Diversification Across Industries

While aerospace and defense are major revenue contributors, ATI’s products are also critical in energy, medical, and industrial applications. This diversification shields the company from sector-specific slowdowns, providing a steady revenue stream.

Key Growth Drivers

1. Rising Demand in Aerospace

The aerospace industry is experiencing a significant rebound as airlines expand their fleets to meet rising passenger demand. ATI’s advanced materials are integral to modern jet engines, which require lightweight, heat-resistant alloys to enhance fuel efficiency and performance. With major aerospace manufacturers ramping up production, ATI stands to benefit significantly.

2. Energy Sector Opportunities

The transition to renewable energy presents lucrative opportunities for ATI. The company’s materials are used in wind turbines, solar panels, and other green energy technologies. As the world shifts towards cleaner energy sources, ATI’s expertise in high-performance materials gives it a competitive edge.

3. Technological Innovation

ATI continues to invest heavily in research and development (R&D). Its focus on creating cutting-edge materials for next-generation technologies ensures it remains ahead of the competition. Recent breakthroughs in additive manufacturing (3D printing) and proprietary alloy development highlight ATI’s innovation-driven growth strategy.

4. Strategic Partnerships and Contracts

ATI has secured long-term contracts with major players in aerospace and energy. These agreements provide revenue visibility and reinforce the company’s market position. Partnerships with firms like Boeing and Airbus underscore ATI’s reputation as a reliable supplier of high-quality materials.

Financial Overview

Revenue and Earnings

ATI has shown consistent revenue growth over the years. In its most recent quarterly report, the company posted impressive revenue figures, driven by increased demand from the aerospace and energy sectors. Net income margins have also improved, reflecting efficient cost management and operational improvements.

Balance Sheet Strength

ATI’s balance sheet demonstrates financial stability, with manageable debt levels and healthy cash reserves. This financial resilience allows the company to invest in growth initiatives without compromising its fiscal health.

Dividend Policy

While ATI does not currently offer a high dividend yield, its focus on reinvesting earnings into growth opportunities signals long-term value creation for shareholders.

Risks to Consider

1. Economic Slowdowns

Global economic uncertainty can impact demand for ATI’s products, especially in sectors like aerospace and industrial manufacturing.

2. Raw Material Price Volatility

ATI’s operations are influenced by fluctuations in raw material prices. However, the company’s focus on advanced materials and premium pricing power mitigates this risk to some extent.

3. Competitive Pressure

While ATI is a leader in its niche, competition from other specialty materials providers could impact market share and pricing.

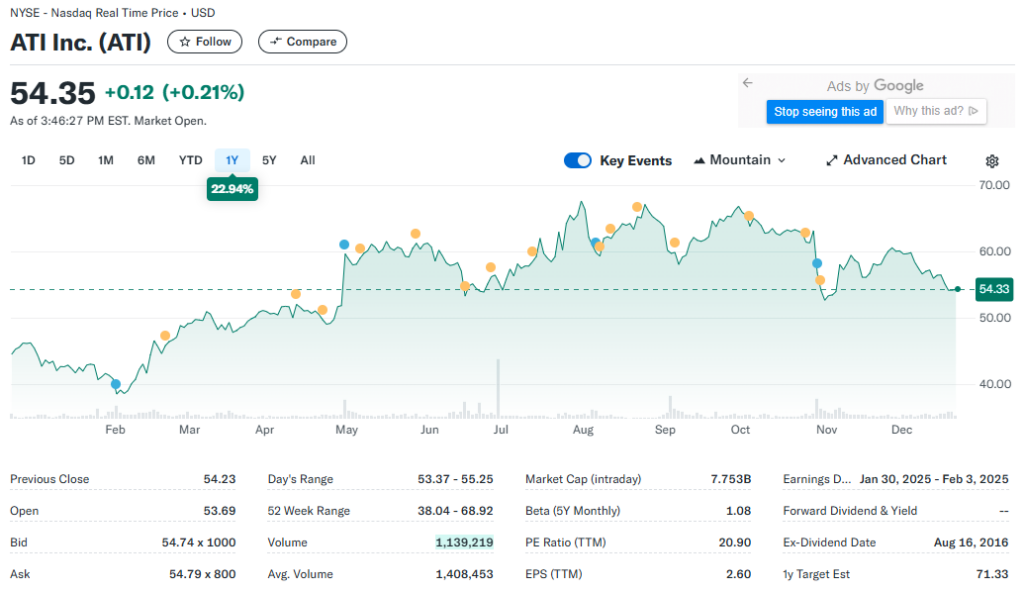

Valuation and Stock Performance

Historical Stock Performance

ATI’s stock has delivered impressive returns in recent years, outpacing many of its industry peers. The recovery in aerospace and the growth in renewable energy have been key drivers of this performance.

Valuation Metrics

ATI’s current price-to-earnings (P/E) ratio is competitive compared to industry averages, indicating potential undervaluation. Additionally, its price-to-sales (P/S) ratio reflects strong revenue generation relative to its market capitalization.

Conclusion

ATI Inc. represents a compelling investment opportunity, backed by its strong market position, diversified revenue streams, and focus on innovation. With the aerospace and energy sectors driving growth, ATI is well-positioned to capitalize on emerging trends. However, investors should carefully consider the risks associated with economic volatility and raw material prices.

For those seeking exposure to advanced materials and industries with high growth potential, ATI Inc. is a stock worth considering. By investing in ATI, you’re not just betting on a company but on the future of aerospace, defense, and sustainable energy.

Call to Action

Are you ready to add ATI Inc. to your portfolio? Conduct your own research and consult with a financial advisor to determine if it aligns with your investment goals. Stay informed, and happy investing!