In the ever-evolving landscape of healthcare, HealthEquity, Inc. (NASDAQ: HQY) has emerged as a significant player. Specializing in health savings accounts (HSAs) and other consumer-directed benefits, HealthEquity is strategically positioned at the crossroads of healthcare and financial technology. For investors seeking exposure to innovative healthcare solutions and the burgeoning HSA market, HealthEquity presents a compelling case. This article delves into the company’s business model, financial performance, market dynamics, competitive advantages, and potential risks to provide a holistic view for prospective investors.

Understanding HealthEquity’s Business Model

Founded in 2002 and headquartered in Draper, Utah, HealthEquity primarily operates in the domain of health savings accounts (HSAs). HSAs are tax-advantaged savings accounts designed for individuals with high-deductible health plans (HDHPs). These accounts allow users to save for medical expenses while enjoying significant tax benefits.

HealthEquity’s revenue streams are diversified into three primary categories:

- Service Revenue: Fees generated from administering HSAs and other related services.

- Custodial Revenue: Interest income earned on HSA cash deposits.

- Interchange Revenue: Fees earned from debit card transactions tied to HSAs.

The company also offers complementary services, including flexible spending accounts (FSAs), health reimbursement arrangements (HRAs), commuter benefits, and COBRA administration. By providing a comprehensive suite of consumer-directed benefits, HealthEquity serves as a one-stop solution for employers and employees alike.

The Expanding Market for HSAs

The U.S. healthcare system’s shift towards high-deductible health plans has fueled the growth of HSAs. According to industry reports, the total number of HSA accounts surpassed 35 million in 2023, with assets exceeding $100 billion. These figures are expected to grow substantially in the coming years, driven by rising healthcare costs and increased adoption of HDHPs by employers.

HealthEquity is well-positioned to capitalize on this trend. As of its most recent filings, the company manages over 7.5 million HSAs, making it one of the largest HSA custodians in the United States. Its extensive distribution network, partnerships with health plans and employers, and technology-driven solutions give it a competitive edge in capturing market share.

Financial Performance

A closer look at HealthEquity’s financials underscores its growth trajectory and operational efficiency. The company’s revenue has grown consistently over the years, reflecting the expanding HSA market and its ability to cross-sell additional services.

- Revenue Growth: HealthEquity reported $846 million in revenue for fiscal year 2023, marking a year-over-year increase of approximately 12%.

- Profitability: The company has demonstrated a strong gross margin, typically in the range of 65% to 70%, showcasing its efficient business operations.

- Cash Flow: HealthEquity’s asset-light model generates robust free cash flow, enabling it to invest in growth initiatives and strategic acquisitions.

The acquisition of WageWorks in 2019 was a transformative move, significantly broadening HealthEquity’s portfolio of consumer-directed benefits. This strategic acquisition has bolstered the company’s competitive position and created synergies that have contributed to margin expansion.

Competitive Landscape

HealthEquity operates in a competitive yet fragmented market. Its primary competitors include:

- Fidelity Investments: Offers HSAs with a focus on investment options.

- Optum Bank (UnitedHealth Group): Leverages its parent company’s vast healthcare network to grow its HSA offerings.

- Bank of America: Combines its banking expertise with HSA administration.

Despite the competition, HealthEquity has carved out a niche through its technology platform, customer service, and holistic product suite. Its user-friendly mobile app, which provides tools for tracking medical expenses and optimizing savings, is a standout feature that enhances customer engagement and retention.

Growth Drivers

Several factors underpin HealthEquity’s growth potential:

- Rising Adoption of HSAs: With employers increasingly offering HSAs as part of their benefits packages, HealthEquity is poised to grow its account base.

- Cross-Selling Opportunities: The company’s broad portfolio enables it to cross-sell complementary services, driving incremental revenue.

- Technological Advancements: HealthEquity’s continued investment in its technology platform enhances user experience and operational efficiency.

- Regulatory Tailwinds: Legislative changes that increase HSA contribution limits or expand eligible expenses could further boost demand.

- Strategic Partnerships and Acquisitions: Collaborations with health plans and targeted acquisitions can accelerate growth and expand market presence.

Potential Risks

While HealthEquity’s prospects are promising, investors should be mindful of potential risks:

- Regulatory Uncertainty: Changes in healthcare policies or tax regulations could impact the HSA market.

- Economic Downturns: Recessions may reduce contributions to HSAs and other consumer-directed benefits.

- Competitive Pressure: The entry of new players or aggressive strategies by incumbents could erode market share.

- Technological Risks: Cybersecurity breaches or technological disruptions could harm the company’s reputation and financial performance.

- Dependency on Interest Rates: A significant portion of custodial revenue is tied to interest rates, making it sensitive to macroeconomic conditions.

Valuation and Investment Considerations

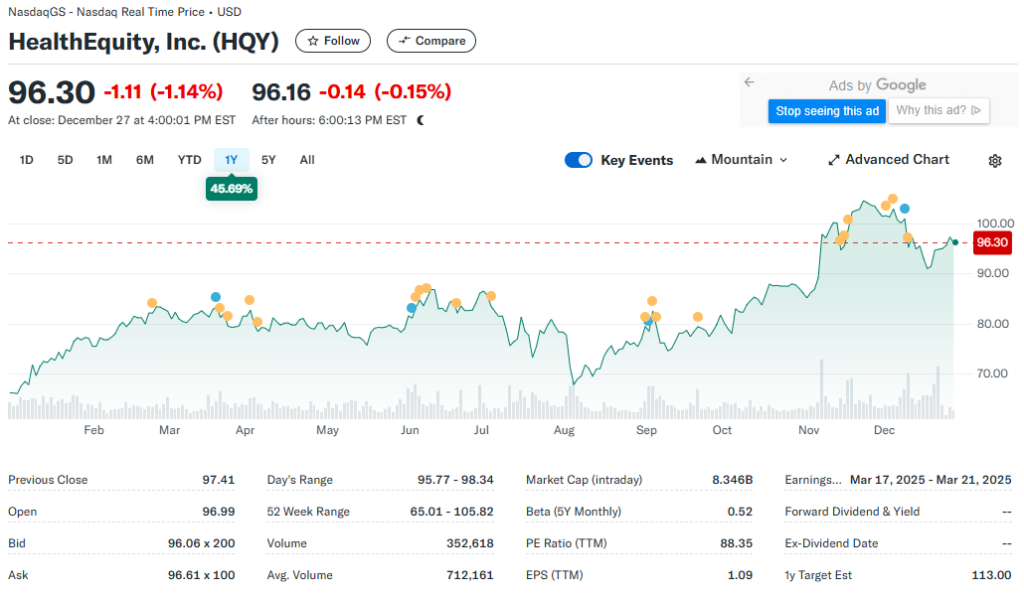

As of late 2023, HealthEquity’s stock trades at a premium valuation relative to the broader market, reflecting its growth potential and leadership position in the HSA space. However, its price-to-earnings (P/E) and price-to-sales (P/S) ratios are within reasonable ranges compared to other fintech and healthcare companies.

Investors should consider the following:

- Long-Term Growth Story: HealthEquity’s exposure to structural trends in healthcare and fintech provides a runway for sustained growth.

- Strong Financials: Consistent revenue growth, healthy margins, and robust cash flow make it a financially sound investment.

- Volatility: As with any growth-oriented stock, HealthEquity’s shares may exhibit volatility, particularly in response to macroeconomic changes or regulatory developments.

Conclusion

HealthEquity, Inc. offers a unique blend of healthcare and financial technology exposure. Its leadership in the HSA market, coupled with a comprehensive suite of consumer-directed benefits, positions it as a key beneficiary of the ongoing transformation in healthcare financing. While risks exist, the company’s growth drivers, competitive advantages, and financial strength provide a solid foundation for long-term success.

For investors with a long-term horizon, HealthEquity represents a promising opportunity to capitalize on the intersection of two dynamic sectors. As always, prospective investors should conduct their due diligence, considering their risk tolerance and investment objectives before making a decision.