FTAI Aviation Ltd. (NYSE: FTAI) is making waves in the aviation industry, capturing the attention of investors looking for opportunities in a niche yet promising segment. Specializing in aircraft leasing and engine solutions, FTAI Aviation provides a unique value proposition that blends the stability of a traditional leasing model with innovative approaches to engine technology. In this article, we explore why FTAI Aviation Ltd. could be a strategic addition to your investment portfolio and examine key factors that make it a standout player in the aviation industry.

Overview of FTAI Aviation Ltd.

FTAI Aviation Ltd. operates as a global leader in aviation leasing and engine aftermarket services. The company’s business model focuses on acquiring and leasing commercial aircraft and engines, with a significant emphasis on maximizing asset utilization. This strategy allows FTAI to generate steady cash flows, even during periods of market volatility.

Core Business Segments

- Aircraft Leasing: FTAI leases a diverse portfolio of commercial aircraft to airlines worldwide. This segment benefits from long-term contracts that provide predictable revenue streams.

- Engine Solutions: The company is at the forefront of engine leasing and aftermarket services, offering comprehensive solutions such as engine sales, maintenance, and parts supply. This segment is a key driver of FTAI’s profitability, given the high demand for engine-related services in the aviation sector.

- Aviation Maintenance: Through its state-of-the-art maintenance facilities, FTAI ensures its leased assets remain in optimal condition, enhancing customer satisfaction and asset longevity.

Why Invest in FTAI Aviation Ltd.?

Investing in FTAI Aviation Ltd. offers exposure to the growing aviation industry, backed by a robust business model and strategic positioning. Below are key reasons why FTAI should be on your radar:

1. Strong Market Position

FTAI Aviation has established itself as a trusted partner for airlines globally. Its ability to offer flexible leasing options and innovative engine solutions differentiates it from competitors. In an industry where reliability and cost efficiency are paramount, FTAI’s tailored offerings resonate with airline operators seeking to optimize operational costs.

2. Growing Demand for Engine Leasing

The demand for engine leasing is on the rise as airlines prioritize asset-light models and seek cost-effective alternatives to outright engine purchases. FTAI’s expertise in engine leasing positions it to capitalize on this trend. The company’s recent investments in next-generation engine technologies further enhance its competitive edge.

3. Resilient Business Model

FTAI’s dual focus on aircraft leasing and engine services provides a balanced revenue mix, ensuring stability even during economic downturns. For instance, during the COVID-19 pandemic, the company’s diversified portfolio allowed it to weather the storm better than many peers in the aviation industry.

4. Attractive Valuation

Compared to its industry peers, FTAI Aviation Ltd. trades at a reasonable valuation, offering an appealing entry point for investors. Its consistent earnings growth and dividend payout add to its investment allure.

5. Environmental Focus

FTAI has embraced sustainability by investing in environmentally friendly engine technologies and adhering to global emissions standards. As the aviation industry faces increasing pressure to reduce its carbon footprint, FTAI’s proactive approach positions it as a responsible and forward-thinking industry leader.

Financial Performance

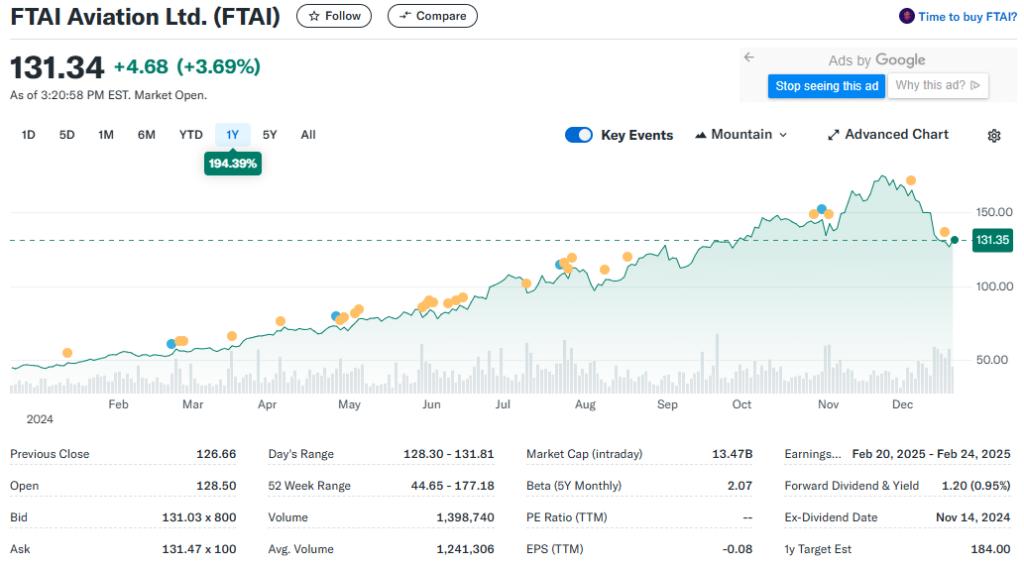

FTAI Aviation has demonstrated solid financial performance over the years, with consistent revenue growth and profitability. Here are some key metrics:

- Revenue Growth: The company’s revenue has steadily increased, driven by strong demand for leasing and aftermarket services.

- Profit Margins: FTAI boasts healthy profit margins, reflecting its efficient operations and high-margin engine solutions business.

- Dividend Yield: FTAI offers an attractive dividend yield, making it a compelling choice for income-focused investors.

Recent Quarterly Results

In its most recent earnings report, FTAI Aviation Ltd. exceeded analyst expectations, reporting:

- Revenue of $466 million, up 60% year-over-year.

- Net income of $86.5 million, driven by robust performance in the engine solutions segment.

- A dividend increase of 1.1%, reflecting management’s confidence in future cash flows.

Industry Trends Favoring FTAI Aviation Ltd.

1. Aviation Industry Recovery

The global aviation industry is recovering rapidly as air travel demand surges post-pandemic. Airlines are increasingly relying on leasing companies like FTAI to meet fleet expansion needs without committing to significant capital expenditures.

2. Focus on Engine Efficiency

Fuel efficiency remains a top priority for airlines, given rising fuel costs and environmental regulations. FTAI’s investment in next-gen engines and aftermarket services ensures it remains a key player in this space.

3. Asset-Light Airline Models

Airlines are shifting toward asset-light models to improve financial flexibility. Leasing aircraft and engines from companies like FTAI reduces capital expenditure while providing access to the latest technologies.

4. Sustainability Initiatives

As global aviation moves toward decarbonization, FTAI’s focus on sustainable practices and technologies aligns with industry goals, ensuring long-term relevance.

Risks to Consider

While FTAI Aviation Ltd. presents an attractive investment opportunity, it is not without risks. Investors should consider:

- Economic Sensitivity: The aviation industry is cyclical and closely tied to global economic conditions. A downturn could impact FTAI’s leasing revenue and profitability.

- Regulatory Challenges: Increasing regulations on emissions and safety standards could pose compliance challenges, potentially increasing operational costs.

- Competition: The aircraft leasing market is competitive, with major players vying for market share. FTAI must continually innovate to maintain its competitive edge.

- Interest Rate Environment: Rising interest rates could impact FTAI’s financing costs, affecting overall profitability.

How to Invest in FTAI Aviation Ltd.

If you’re considering adding FTAI Aviation Ltd. to your portfolio, here are some steps to get started:

- Research Thoroughly: Review FTAI’s financial statements, earnings reports, and industry trends to ensure alignment with your investment goals.

- Set Investment Goals: Determine whether you’re investing for growth, income, or a combination of both. FTAI’s dividend yield makes it suitable for income investors.

- Monitor Industry Developments: Stay updated on aviation industry trends and regulatory changes that could impact FTAI’s business.

- Diversify Your Portfolio: While FTAI offers compelling opportunities, diversification remains key to mitigating risk.

Conclusion

FTAI Aviation Ltd. is a promising investment opportunity in the aviation sector, offering exposure to a growing market with robust demand for leasing and engine solutions. Its resilient business model, strong financial performance, and focus on sustainability make it a standout choice for investors. However, as with any investment, it’s essential to consider the associated risks and conduct thorough research.

By strategically positioning itself in the aviation leasing and engine aftermarket segments, FTAI Aviation Ltd. is poised to deliver value to shareholders in the years to come. Whether you’re a growth-oriented investor or seeking steady income through dividends, FTAI deserves a closer look.

Leverage these insights to make informed decisions about your investment strategy and consider FTAI Aviation Ltd. as a cornerstone for growth in the dynamic aviation sector.