Light & Wonder, Inc. (NASDAQ: LNW), formerly known as Scientific Games Corporation, is a prominent name in the global gaming and entertainment industry. The company has successfully transitioned from a broad-focused business to a more streamlined entity, focusing on digital gaming, content creation, and systems that power casinos and online platforms. This strategic shift has attracted considerable investor interest, especially as Light & Wonder strengthens its position in digital gaming and iGaming markets. In this article, we delve into the company’s financial performance, growth opportunities, competitive position, and potential risks to determine whether LNW stock is a strong investment opportunity.

Light & Wonder: Business Overview

Light & Wonder operates as a leading provider of gaming products and services for both land-based and digital platforms. The company’s transformation, following the sale of its lottery business and sports betting arm, has allowed it to sharpen its focus on three key segments:

- Gaming Systems and Machines: Light & Wonder designs and supplies cutting-edge gaming machines, platforms, and content for land-based casinos.

- iGaming: The company’s online gaming content and platform solutions cater to the growing digital gaming market.

- Social Gaming: Through its SciPlay division, Light & Wonder develops and distributes mobile social casino games that generate recurring revenues.

This streamlined model gives Light & Wonder a competitive edge in high-margin, technology-driven markets where demand for interactive gaming experiences continues to grow.

Financial Performance

Revenue Growth

Light & Wonder has been experiencing a turnaround in its financials following its transformation strategy. In FY 2023, the company reported $2.9 billion in revenue, representing a 17% year-over-year increase. The growth was primarily driven by strong performance in the Gaming and iGaming segments.

- Gaming Revenue grew by 14%, supported by higher unit sales of gaming machines and increased adoption of premium game titles.

- iGaming Revenue surged by 21%, highlighting Light & Wonder’s success in digital markets, particularly in North America and Europe.

- SciPlay Revenue saw a modest increase of 8%, reflecting strong user engagement in the mobile social casino space.

Profitability

Light & Wonder has significantly improved its profitability since its restructuring. The company reported an Adjusted EBITDA of $1 billion for FY 2023, up 20% from the previous year, driven by higher margins in digital gaming and cost optimizations.

Balance Sheet Strength

One of Light & Wonder’s most significant achievements is its deleveraging strategy. The sale of its lottery division allowed the company to reduce its net debt from $8 billion to $3.5 billion. As of the latest quarter, Light & Wonder maintains a net debt-to-EBITDA ratio of 3.5x, reflecting a healthier balance sheet and increased financial flexibility.

Key Growth Drivers

1. Expansion in Digital Gaming and iGaming

The digital gaming and iGaming markets represent a massive growth opportunity for Light & Wonder. As the global online gambling industry is projected to grow at a CAGR of 10-12% through 2030, Light & Wonder’s iGaming segment is well-positioned to capture significant market share.

- The company’s OpenGaming Platform is gaining traction among operators, providing an integrated solution for content and player management.

- Partnerships with leading online gaming platforms, such as BetMGM and DraftKings, underscore Light & Wonder’s competitive position in the digital market.

2. Innovation in Land-Based Gaming Machines

While digital gaming continues to grow, land-based casinos remain a critical segment for Light & Wonder. The company’s latest Quantum and Kascada gaming machines have received positive feedback, driving unit sales and expanding market share. Additionally, Light & Wonder’s focus on premium game titles, like Dragon Link and Dancing Drums, has contributed to increased recurring revenue from game placements.

3. Social Casino Gaming through SciPlay

SciPlay, Light & Wonder’s mobile gaming arm, generates recurring revenues from in-game purchases. The social casino market is projected to grow steadily, supported by higher mobile usage and improved player monetization strategies. With a diversified portfolio of games and strong user retention, SciPlay remains a valuable asset for Light & Wonder’s overall growth strategy.

4. Global Expansion Opportunities

Light & Wonder is actively expanding its presence in international markets, particularly in Europe, Asia, and Latin America. Regulatory advancements in online gambling in these regions present significant opportunities for the company’s iGaming and systems businesses.

Risks to Consider

While Light & Wonder has substantial growth potential, investors should also consider the following risks:

- Competitive Pressures: The gaming and iGaming industries are highly competitive. Light & Wonder faces competition from established players like International Game Technology (IGT), Aristocrat Leisure, and Evolution Gaming.

- Regulatory Uncertainty: The gaming industry is heavily regulated. Changes in regulations, particularly in the United States or Europe, could impact Light & Wonder’s operations and revenue streams.

- Economic Downturns: Gaming and entertainment are discretionary spending sectors, making Light & Wonder’s revenue vulnerable to economic downturns or recessions.

- Technological Disruption: Rapid advancements in gaming technology require ongoing investments in innovation. Failure to keep pace with competitors could erode Light & Wonder’s market position.

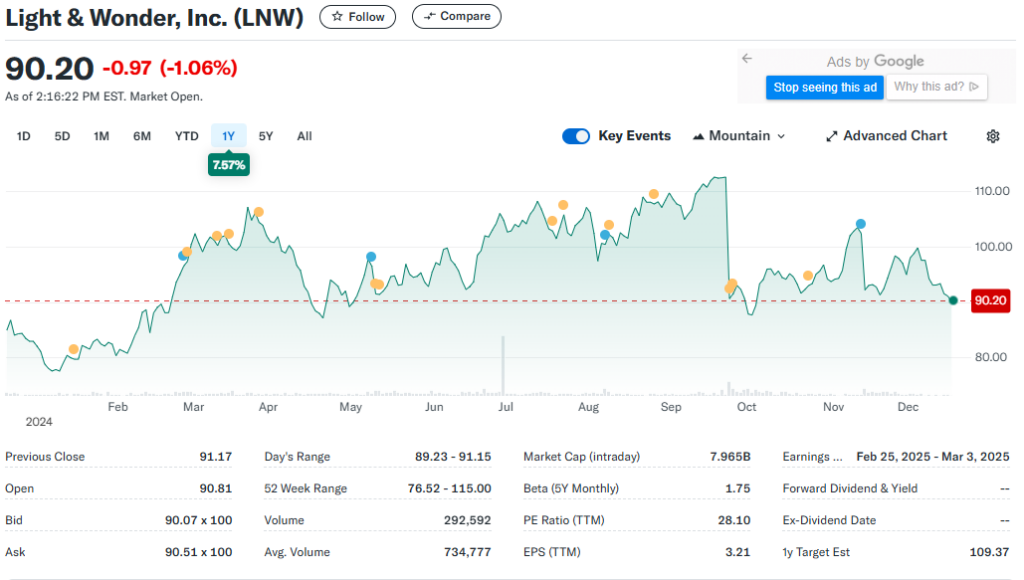

Stock Performance and Valuation

Light & Wonder’s stock has performed well over the past year, gaining approximately 35% year-to-date, outperforming broader market indices and many of its competitors in the gaming sector.

The stock currently trades at a forward P/E ratio of 22x, which is slightly above its historical average but reasonable given the company’s growth potential and improving profitability. Analysts project double-digit earnings growth for the next three years, driven by strong momentum in iGaming and improved margins.

Conclusion: Is Light & Wonder a Buy?

Light & Wonder, Inc. has successfully reinvented itself as a focused, growth-oriented business with strong positions in both land-based and digital gaming markets. The company’s robust financial performance, improving margins, and deleveraged balance sheet highlight its potential for long-term growth.

Investors looking for exposure to the gaming and entertainment sectors should find Light & Wonder an attractive option. Its growth opportunities in iGaming, digital platforms, and social casino gaming align well with industry trends. While risks such as regulatory challenges and economic uncertainty exist, Light & Wonder’s strategic initiatives and global expansion plans provide a solid foundation for future success.

For long-term investors, Light & Wonder offers a compelling mix of growth, innovation, and financial stability, making it a worthy addition to a diversified portfolio.

Disclosure: The author does not hold any position in Light & Wonder, Inc. at the time of writing.