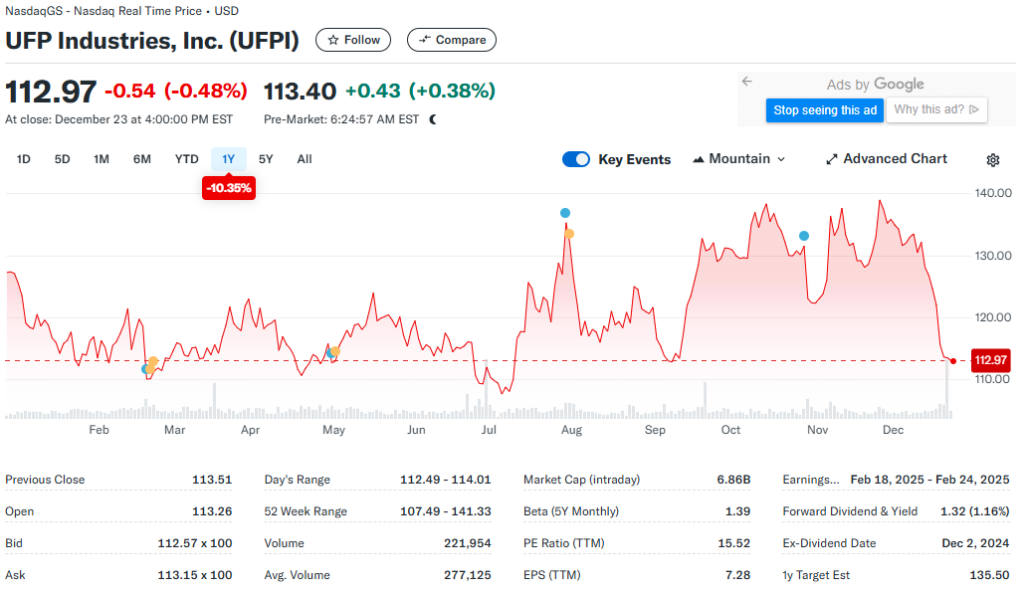

UFP Industries, Inc. (NASDAQ: UFPI), formerly known as Universal Forest Products, Inc., is a multifaceted industrial company with a rich history and a diverse range of operations. Established in 1955, UFP Industries has grown into a global powerhouse in the wood products industry, offering a compelling mix of manufacturing, distribution, and innovative solutions. This article delves into the factors that make UFP Industries an intriguing investment opportunity, analyzing its business model, financial performance, growth prospects, and key risks.

Business Overview

UFP Industries operates in three primary segments:

- Retail Solutions: This segment primarily serves big-box retailers and independent lumberyards, offering products like decking, fencing, and other outdoor living solutions. The segment benefits from strong consumer trends toward home improvement and outdoor living.

- Industrial Solutions: UFP’s industrial segment caters to a diverse set of industries, providing packaging and material handling solutions made from wood, plastic, and other materials. This segment showcases the company’s ability to diversify its revenue streams and mitigate cyclical risks.

- Construction Solutions: This division supplies structural lumber, engineered wood components, and other building materials for residential and commercial construction projects. UFP is strategically positioned to capitalize on the long-term growth in housing demand and infrastructure investments.

These segments illustrate UFP’s ability to adapt to various markets and capitalize on diverse revenue streams. Its broad portfolio mitigates risks associated with reliance on any single sector.

Financial Performance

One of UFP Industries’ standout characteristics is its robust financial performance. Here are some key highlights:

- Revenue Growth: UFP has consistently grown its revenue over the years. Its ability to integrate acquisitions and expand its product offerings has been a driving force behind this growth. In recent years, the company has achieved significant revenue milestones, reflecting its operational efficiency and market reach.

- Profit Margins: The company has demonstrated impressive operating and net profit margins, thanks to its focus on cost management and value-added products. The strategic emphasis on higher-margin offerings like engineered wood products has bolstered its profitability.

- Strong Balance Sheet: UFP boasts a healthy balance sheet with manageable debt levels and ample liquidity. This financial strength positions the company to weather economic downturns and seize growth opportunities through acquisitions and capital investments.

- Dividend Policy: UFP’s commitment to returning value to shareholders is evident in its steady dividend payments. The company’s dividend yield, while not the highest in the industry, reflects a stable and growing income stream for investors.

Growth Drivers

Several factors underpin UFP Industries’ growth trajectory:

- Residential Construction Demand: The U.S. housing market has experienced sustained demand due to population growth, urbanization, and a shortage of housing inventory. UFP’s construction solutions segment is well-positioned to benefit from these trends.

- Outdoor Living Trends: Consumers increasingly invest in outdoor living spaces, driving demand for decking, fencing, and other products. UFP’s retail solutions segment has capitalized on this trend, offering innovative and sustainable products.

- Industrial Packaging Expansion: The global rise in e-commerce and manufacturing activity has increased demand for packaging solutions. UFP’s industrial segment has responded by diversifying its materials and customizing solutions to meet client needs.

- Sustainability Focus: UFP has embraced sustainability by developing products made from recycled and renewable materials. This aligns with global trends toward environmentally responsible practices and enhances the company’s appeal to eco-conscious consumers.

- Strategic Acquisitions: UFP has a proven track record of acquiring and integrating complementary businesses. These acquisitions have expanded its geographic footprint, diversified its product portfolio, and added to its expertise in high-growth markets.

Competitive Advantages

UFP Industries enjoys several competitive advantages that enhance its market position:

- Vertical Integration: UFP’s vertically integrated operations enable it to control costs, ensure product quality, and maintain supply chain efficiency. This gives the company a significant edge over competitors.

- Diverse Product Portfolio: With products catering to retail, industrial, and construction markets, UFP has reduced its dependence on any single sector, making its revenue streams more resilient.

- Innovation: UFP invests heavily in research and development to create value-added products and customized solutions. Its commitment to innovation has strengthened customer loyalty and driven market share gains.

- Geographic Reach: UFP’s extensive distribution network spans North America and other key regions. This geographic diversity helps mitigate regional economic fluctuations and positions the company for global opportunities.

Risks and Challenges

While UFP Industries presents a compelling investment case, potential risks should not be overlooked:

- Cyclical Nature of Construction: The construction industry is inherently cyclical, and downturns in housing or commercial construction could impact UFP’s performance.

- Raw Material Costs: UFP relies heavily on lumber and other raw materials, making it vulnerable to price fluctuations. While the company’s vertical integration provides some insulation, prolonged cost inflation could pressure margins.

- Economic Slowdowns: Broader economic slowdowns or recessions could reduce consumer spending and industrial activity, affecting demand across all segments.

- Competition: UFP operates in highly competitive markets. While its innovation and vertical integration provide advantages, competitors’ aggressive pricing or product launches could erode market share.

- Regulatory Risks: Changes in environmental regulations or trade policies could impact UFP’s operations and costs. The company’s focus on sustainability helps mitigate this risk, but compliance with evolving standards remains a challenge.

Investment Outlook

UFP Industries is well-positioned for long-term growth, supported by its diverse business model, robust financials, and strong industry trends. The company’s emphasis on innovation, sustainability, and strategic acquisitions underscores its commitment to creating shareholder value.

- Valuation: UFP’s valuation metrics, such as price-to-earnings (P/E) and enterprise value-to-EBITDA ratios, are competitive compared to industry peers. This makes the stock an attractive option for value and growth-oriented investors.

- Dividend Growth: UFP’s steady dividend growth is a testament to its financial health and management’s commitment to rewarding shareholders. The dividends, coupled with potential capital appreciation, make the stock appealing for income-focused investors.

- ESG Considerations: UFP’s sustainability initiatives align with growing investor interest in environmental, social, and governance (ESG) factors. This could attract institutional investors and enhance the company’s reputation.

Conclusion

UFP Industries, Inc. represents a unique blend of stability and growth potential, making it a noteworthy contender for investors seeking exposure to the industrial and wood products sectors. Its diversified business segments, strong financials, and alignment with key industry trends position the company for sustained success.

However, investors should weigh the potential risks, particularly those associated with economic cycles and raw material volatility. A well-rounded investment strategy that considers these factors can help mitigate risks while capitalizing on UFP’s promising growth prospects.

In conclusion, UFP Industries is a solid investment opportunity for those looking to benefit from the convergence of construction growth, sustainability trends, and innovative solutions. With prudent management and a proven track record, the company’s future appears bright, making it a stock worth considering for both growth and income investors.