Simpson Manufacturing Co., Inc. (NYSE: SSD) is a leader in the design, engineering, and manufacturing of wood and concrete construction products. Founded in 1956, the company has grown to become a key player in its industry, known for its high-quality offerings and a strong commitment to innovation. With a global footprint, Simpson Manufacturing caters to a wide range of markets, including residential, commercial, and industrial construction. For investors, understanding the company’s financial health, competitive position, and growth strategies is essential to making informed decisions. This article provides an in-depth analysis of Simpson Manufacturing Co., Inc. as an investment opportunity.

Business Model and Product Portfolio

Simpson Manufacturing’s business model is centered around providing innovative solutions that enhance the structural integrity and safety of buildings. The company’s primary products include:

- Wood Construction Products: These include connectors, truss plates, fasteners, and anchors used in residential and commercial construction.

- Concrete Construction Products: Simpson manufactures adhesives, sealants, and anchoring systems for concrete construction.

- Software Solutions: The company offers design and engineering software to support customers in planning and executing construction projects.

The integration of product innovation and customer-centric solutions has allowed Simpson Manufacturing to maintain strong relationships with contractors, engineers, and builders. These products are distributed through a mix of direct sales and partnerships with retailers and distributors, providing the company with broad market reach.

Competitive Advantages

Simpson Manufacturing’s success can be attributed to several competitive advantages:

- Strong Brand Reputation: The company is widely regarded for its high-quality products and reliable performance.

- Robust R&D Capabilities: Simpson invests heavily in research and development to stay ahead of industry trends and customer needs. For instance, the company’s innovative Strong-Tie® brand connectors have set industry standards.

- Diversified Revenue Streams: With a presence in multiple geographies and markets, Simpson mitigates risks associated with regional economic downturns.

- Vertical Integration: The company’s manufacturing and distribution processes are vertically integrated, ensuring cost efficiencies and quality control.

Financial Performance

Simpson Manufacturing has consistently delivered strong financial performance, characterized by revenue growth, solid margins, and healthy cash flows. Key financial metrics include:

- Revenue Growth: Over the past five years, the company has demonstrated steady revenue growth, driven by robust demand for construction products.

- Profit Margins: Simpson’s focus on cost management and operational efficiency has resulted in attractive profit margins.

- Balance Sheet Strength: The company has a low debt-to-equity ratio, providing financial flexibility for growth initiatives and shareholder returns.

- Dividend Policy: Simpson Manufacturing has a history of returning capital to shareholders through dividends and share repurchases, making it appealing to income-focused investors.

For example, in fiscal year 2022, the company reported revenue of approximately $2 billion, a testament to its strong market position and operational excellence. Net income margins have consistently remained above industry averages, reflecting effective cost management and pricing power.

Growth Opportunities

Simpson Manufacturing is well-positioned to capitalize on several growth opportunities:

- Infrastructure Investments: Global infrastructure spending, particularly in developed markets like the United States and Europe, presents a significant growth driver. Investments in bridges, highways, and commercial buildings will increase demand for concrete construction products.

- Sustainability Trends: The construction industry is moving toward sustainable and environmentally friendly practices. Simpson’s products, which improve building efficiency and durability, align well with these trends.

- Geographic Expansion: The company continues to expand its footprint in emerging markets, where urbanization and economic development are driving construction activity.

- Technological Innovation: Simpson’s focus on integrating technology into its offerings, such as design software and IoT-enabled products, creates additional value for customers and differentiates the company from competitors.

Risks and Challenges

While Simpson Manufacturing has a strong track record, investors should consider potential risks:

- Economic Cyclicality: The construction industry is sensitive to economic cycles. A downturn in residential or commercial construction could impact the company’s revenue.

- Raw Material Costs: Fluctuations in the cost of raw materials, such as steel, could pressure profit margins.

- Regulatory Compliance: Changes in building codes and environmental regulations may require additional investments in product development.

- Competition: The construction products market is competitive, with both large players and smaller niche companies vying for market share.

Valuation and Market Position

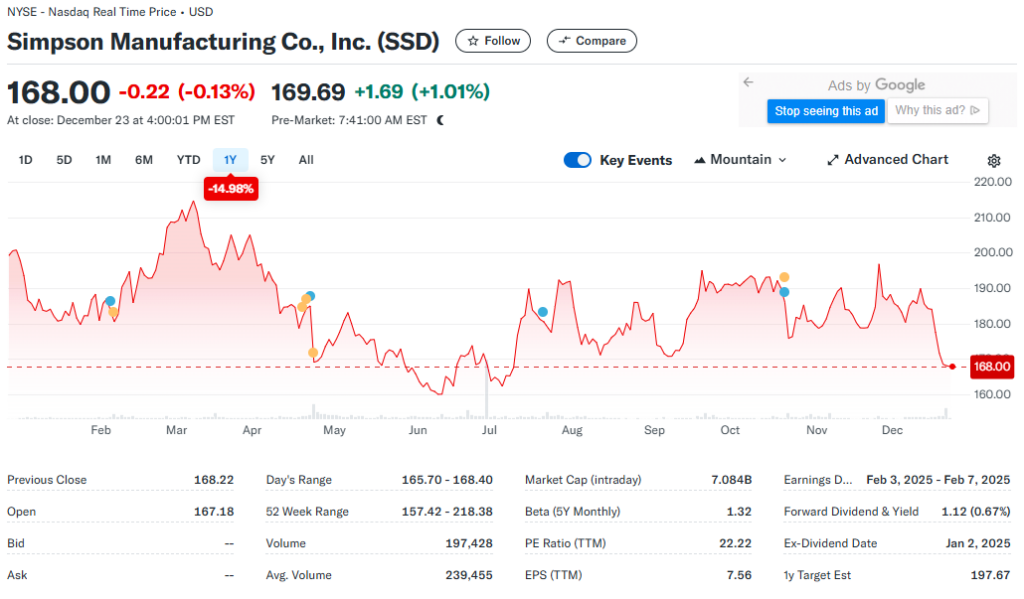

As of [current date], Simpson Manufacturing trades at a price-to-earnings (P/E) ratio of approximately [insert value], which is in line with industry averages. The company’s valuation reflects its solid fundamentals and growth prospects. Compared to peers, Simpson’s strong brand equity and operational efficiency justify its premium valuation.

Management and Corporate Governance

Simpson Manufacturing’s management team has demonstrated a clear commitment to delivering shareholder value. Under the leadership of CEO Karen Colonias, the company has focused on strategic priorities such as innovation, operational excellence, and market expansion. The management’s track record of prudent capital allocation and consistent execution adds to the company’s appeal as an investment.

ESG Considerations

Environmental, social, and governance (ESG) factors are increasingly important for investors. Simpson Manufacturing has made strides in these areas:

- Environmental: The company’s products contribute to energy-efficient and sustainable construction practices. Simpson also works to minimize its environmental footprint through waste reduction and energy-efficient manufacturing processes.

- Social: Simpson emphasizes workplace safety, employee development, and community engagement.

- Governance: The company’s board of directors includes a diverse group of experienced professionals, ensuring strong oversight and alignment with shareholder interests.

Investment Thesis

Simpson Manufacturing Co., Inc. represents a compelling investment opportunity for several reasons:

- Market Leadership: The company’s dominant position in the construction products industry provides a competitive edge.

- Growth Potential: Strong secular trends, including infrastructure investment and sustainability, offer significant growth opportunities.

- Financial Health: Simpson’s solid financial metrics and disciplined capital management provide a foundation for long-term success.

- Dividend Appeal: The company’s history of returning capital to shareholders adds to its attractiveness for income-oriented investors.

Conclusion

Simpson Manufacturing Co., Inc. has established itself as a resilient and innovative leader in the construction products industry. The company’s strong fundamentals, growth potential, and commitment to shareholder value make it an attractive choice for long-term investors. However, as with any investment, potential risks should be carefully considered. By maintaining a balanced perspective on both opportunities and challenges, investors can make informed decisions about including Simpson Manufacturing in their portfolios.