Sprouts Farmers Market, Inc. (NASDAQ: SFM) is a rapidly growing chain of supermarkets that caters to the increasing consumer demand for fresh, natural, and organic products at competitive prices. Founded in 2002 and headquartered in Phoenix, Arizona, Sprouts has carved out a niche in the grocery industry by combining the charm of a local farmers market with the convenience of a full-service supermarket. For investors seeking opportunities in the health and wellness sector, Sprouts presents a compelling case. Let’s dive into the financial performance, growth strategies, competitive positioning, and potential risks associated with investing in Sprouts Farmers Market, Inc.

Overview of Sprouts Farmers Market

Sprouts Farmers Market operates over 370 stores across 23 states in the U.S., with a strong presence in the western and southwestern regions. The company’s core focus is on fresh produce, which accounts for a significant portion of its sales. Alongside produce, Sprouts offers a wide range of products, including vitamins, bulk foods, packaged groceries, dairy, meat, and bakery items, many of which are natural or organic.

What sets Sprouts apart is its commitment to offering high-quality products at affordable prices. The company’s mission aligns well with the growing consumer trend toward health-conscious eating and sustainable living.

Financial Performance

Understanding the financial health of a company is crucial for investors. Sprouts Farmers Market has demonstrated consistent revenue growth over the years, driven by an expanding store footprint and strong same-store sales performance. In its most recent fiscal year, Sprouts reported:

- Revenue Growth: Annual revenue of over $6 billion, reflecting a steady upward trajectory.

- Net Income: Strong profitability, with net income margins generally above industry averages.

- Cash Flow: Healthy operating cash flow, enabling the company to reinvest in growth initiatives and maintain financial flexibility.

Sprouts’ management has also been focused on improving operational efficiencies, which has helped the company maintain competitive margins despite inflationary pressures in the grocery sector.

Growth Strategies

Sprouts Farmers Market has outlined several strategies to sustain its growth and enhance shareholder value:

- Store Expansion: The company plans to open 30-40 new stores annually, targeting underserved markets and expanding its geographic reach. Sprouts’ smaller store format allows for flexibility in site selection and efficient operations.

- E-Commerce Integration: Recognizing the shift toward online shopping, Sprouts has invested in its digital infrastructure. The company offers delivery and pickup services through partnerships with Instacart and other platforms, making it easier for customers to shop.

- Product Innovation: Sprouts continues to introduce new private-label products and expand its assortment of plant-based, gluten-free, and keto-friendly options. This not only attracts a broader customer base but also enhances profit margins.

- Sustainability Initiatives: Sprouts’ focus on sustainability—from sourcing responsibly grown produce to reducing food waste—resonates with environmentally conscious consumers and strengthens its brand reputation.

Competitive Positioning

The grocery industry is highly competitive, with major players like Kroger, Whole Foods (owned by Amazon), and Trader Joe’s vying for market share. However, Sprouts Farmers Market differentiates itself in several key ways:

- Fresh Produce Leadership: Sprouts’ emphasis on fresh, high-quality produce at competitive prices has helped it build a loyal customer base.

- Niche Market Focus: By targeting health-conscious consumers, Sprouts occupies a unique space between traditional supermarkets and specialty grocers.

- Smaller Store Format: Sprouts’ stores are typically around 30,000 square feet, smaller than traditional supermarkets. This format allows for a curated shopping experience and lower operating costs.

Industry Trends and Opportunities

Investors should consider the broader trends shaping the grocery and health food industries when evaluating Sprouts Farmers Market. Key trends include:

- Rising Demand for Organic and Natural Foods: According to industry reports, the global organic food market is projected to grow at a CAGR of 8-10% over the next several years. Sprouts is well-positioned to benefit from this trend.

- Health and Wellness Movement: Consumers are increasingly prioritizing health and wellness, driving demand for natural and organic products. Sprouts’ focus on these categories aligns perfectly with consumer preferences.

- Digital Transformation: The pandemic accelerated the adoption of e-commerce in the grocery sector. Sprouts’ investments in digital capabilities ensure it remains competitive in this space.

Risks to Consider

While Sprouts Farmers Market offers significant growth potential, investors should also be aware of the associated risks:

- Intense Competition: The grocery industry is highly competitive, with pricing wars and market saturation posing challenges to profitability.

- Economic Uncertainty: Inflation and economic downturns could impact consumer spending habits, particularly on premium-priced organic products.

- Supply Chain Disruptions: Like many retailers, Sprouts is vulnerable to supply chain disruptions that can affect inventory levels and costs.

- Regulatory Risks: Changes in food safety regulations or labeling requirements could increase operational costs.

Investment Considerations

For investors considering Sprouts Farmers Market, here are some key factors to evaluate:

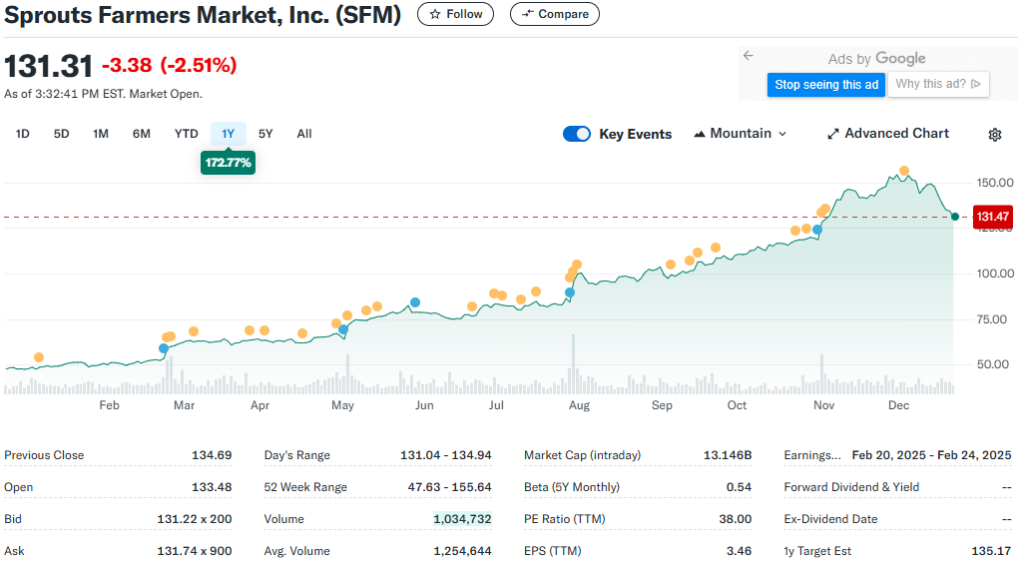

- Valuation: Compare Sprouts’ price-to-earnings (P/E) ratio and enterprise value-to-EBITDA (EV/EBITDA) multiples to industry peers to assess whether the stock is fairly priced.

- Dividend Policy: Sprouts does not currently pay a dividend, opting instead to reinvest profits into growth. This may appeal to growth-oriented investors but not those seeking income.

- Management Team: Evaluate the track record of Sprouts’ leadership team in executing the company’s growth strategy and navigating industry challenges.

- Market Sentiment: Keep an eye on analyst ratings and institutional investor activity to gauge market sentiment toward the stock.

Conclusion

Sprouts Farmers Market, Inc. presents an intriguing opportunity for investors looking to capitalize on the growing demand for natural and organic foods. The company’s strong brand, consistent financial performance, and strategic growth initiatives position it well for long-term success. However, potential investors should conduct thorough due diligence and consider the competitive and economic risks inherent in the grocery sector.

In summary, Sprouts Farmers Market offers a unique blend of growth potential and stability, making it a worthy addition to the portfolio of investors who believe in the future of health-conscious consumerism. As always, diversification and a well-researched investment strategy are key to maximizing returns and minimizing risks.